The Strategic Planning Process

Step 1: Environmental Scanning

It’s always good to have an accurate sense of the bigger picture: what’s going on in your locality and the world at large. In fact, it’s so helpful that I created a chart to break it down, which you can find right here.

Otherwise, you’re going to be operating with blinders on, utterly unaware of and unprepared for what’s about to happen… concerning new opportunities and threats… and about all the people that might broker the deals you want to make. In which case, your strategic planning just won’t be as effective.

It might not even work at all.

To set up an environmental scan, you must first identify the most important issues and trends related to your strategy. Ask yourself:

- How could demographic changes alter community needs?

- What emerging technologies could disrupt operations?

- What cultural and societal shifts are brewing?

- How might the economy, regulations, and policies evolve?

- What political or industry developments could affect us?

Try to identify five to 10 plausible priority problems. This should help keep your focus on what you should be scanning for.

The best way to approach this task is to assemble a project team and other key stakeholders, then lay out a blank board. Ask everyone for their input, making sure to promote as open a process as possible. Don’t filter out ideas. Just work at creating a wide-ranging list of everything that comes to mind.

Once you’re done with that, it’s time to get more discerning. Consolidate all those responses into a shortlist: your most pressing strategic issues. Then keep drilling down from there, asking why each one is considered critical. If something changed in each area addressed, what would it mean for the outlined mission and its strategic priorities?

The more criticality or “impactfulness” you can come back with, the better!

You could also benefit from inviting a variety of internal and external stakeholders to provide input. Perhaps use business resources from companies like Consortia Research Studies or Crowdsource. Or create a question space. Maybe stage a meeting at an event or request input that’s been gathered from your advisory groups. There are plenty of options to choose from.

Still another possibility to consider is asking for a volunteer team to research trends within your field (meaning your career choice like human resources, operations management, accounting, etc.). Industry trends, which refer to the type of organization you serve, such as a church, college, or manufacturing, can serve as another source of inspiration. However, it’s important to ensure that you don’t simply copy and paste anything you find. Make sure themes resonate with your exact organization’s strategy and context.

For the record, the more C-suite involvement in all of this, the better. Executives from all disciplines – from the CFO (chief operating officer) to the CTO (chief technical officer) to the CHRO (chief human resources officer) – could form a cross-functional team to bring a fresh perspective and directly influence the overall organizational assessment theme.

Once compiled, you should turn this list of strategic priorities into an actionable list of five to 10 strategic issues. Get your selected team together in sessions to sort each out as best you can through techniques such as multi-voting, prioritization matrices, and rank ordering, all of which are worth detailing.

Multi-Voting

Multi-voting, also known as dot voting, allows a group of people to prioritize a list of options, enabling each individual to vote for numerous possibilities in the order of their choice. Often used for less complex decision-making processes, it’s a well-liked method for enhancing participation and consensus-building.

To incorporate multi-voting, start out by charting all the ideas you want to decide between on a dry erase board or something similar, and put it somewhere that’s visible to all team members. Then hand out the same quantity of sticky dots to each participant, explaining to them that every dot stands for a vote.

Some facilitators allow just one vote per listed idea. And that decision might be right for you, your group, and your list. But as for In HIS Name HR, we typically allow participants to use all their dots on a single option if they so choose. It helps bring the importance of that idea front and center.

Team members are then instructed to quietly but collectively place their dots on the concepts they like best. And, once everyone’s gone, the facilitator then highlights the top five with the most votes.

When done correctly, multi-voting:

- Gives everyone the chance to take part in the decision-making process

- Solicits opinions from even the most bashful or introverted employees

- Reduces the number of options down to a small number of highly prioritized possibilities

- Expedites the decision-making process.

In short, it’s a quick, easy, and inclusive method of identifying core issues that you really want to focus on.

Prioritization Matrix

Many organizations use prioritization matrices as an invaluable tool to aid in decision-making for both individuals and groups. It offers a methodical way to evaluate and rank various solutions according to predetermined standards. Using a prioritization matrix, you can prioritize jobs, projects, goals, or anything else that requires careful thought.

It’s essentially a graph, with the x-axis representing impact and potential rewards, and the y-axis standing for importance and urgency. Resulting decisions should fall into four quadrants: First Priority, Second Priority, Third Priority, and Unnecessary.

If graphs aren’t your happy place, there’s no need to worry. Numerous software companies offer prioritization matrix solutions for both Microsoft and iOS environments. Better yet, the software is typically an add-on to already existing tools you probably work with all the time such as Outlook, Excel, and Microsoft Project.

Rank Ordering

The term “rank order” describes the arrangement of votes according to a shared metric or characteristic. Very similar to multi-voting, each team member assigns a numeric value to each project they’re voting on, with higher numbers indicating higher priorities.

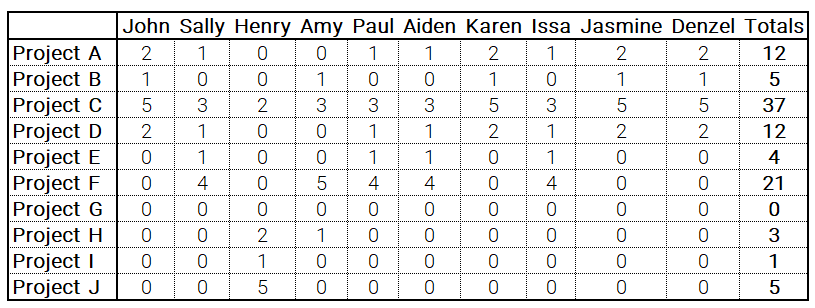

As shown in the next graphic, each member is given 10 points to indicate how they perceive the importance and urgency of the project. They can give a single project the full 10 points if they want or spread them out more generously. Regardless of their ultimate decisions, everyone’s scores are then added up per project to determine final ranking.

In this example, you can see Project C would take priority by quite a bit. The next runner up is Project F, with A and D tying for third.

Once again, this is a great tool to provide transparency and allow participants to visually see how the group perceives the various projects their organization is working on.

Group Deliberation

Regardless of how you determine what is what, be prepared to set aside your preferences and be open to what the collective wisdom comes up with. Keep asking everyone along the way, “If we did nothing different, what external influences could dramatically affect our goals and outcomes next year?”

Even better, think about how shifts in the stakes might give rise to potential harms or benefits surrounding your collective:

- Ability to deliver value and services

- Community reach, awareness, and access

- Funding, resources, and sustainability

- Operations, workforce, and infrastructure.

Yes, you might need to shift your priorities as a result. But that might be precisely what you need. These questions should be a starting point to help you conduct deeper, more effective scanning with deeper, more productive answers to work with.

Gather Crucial Community Demographic Data

Demographic data offers a statistical blueprint of the population you want to reach. It’s priceless in the planning context.

When scanning for this type of information, you’ll want to seek out data points about:

- Age distribution

- Income levels

- Education attainment

- Racial diversity

- Language backgrounds

- Employment status and type

- Geographic density, including how concentrated or dispersed your population is with what migration patterns.

This helps tailor strategies to community needs. For example, rapid growth in seniors indicates a need for more eldercare services. Lower incomes in certain neighborhoods might prompt new affordability programs. And how about sales and/or donor revenue: Where are they coming from and how do they impact you?

Sources for demographic data include the national census, local government data, market research firms, academic institutions, and community surveys.

If you can, break out your current service area into regional, state, and national statistics. Then learn about surrounding areas and their demographics. Does it match your area? If not and you want to eventually reach outside of your direct community, does your business model need to change so it’s applicable to a larger geographical context?

As you assess the data, ask even more questions like:

- Are certain population segments growing or declining?

- Are there noticeable geographic concentrations or segmentation by factors like age, income, education, and language?

- What does the data imply about community needs and your strategy going forward?

Don’t ignore any information you come across. It might not seem important at the moment, but take note of it anyway. And make sure to consider temporal trends. Where have shifts been most rapid? Why did they take place? What do likely future swings look like in light of existing patterns? Balance all this with qualitative data such as community forums or focus groups for context around the numbers.

Keep asking what demographic shifts could create a threat, an opportunity, or require a change in strategic positioning. There are no hypothetical limits in this drill. Not when it comes to the services and programs needed; when, and where you deliver them; the workforce, technology, and infrastructure required; and partnerships that could help expand reach and value.

American Form Inc. reports that “firms that use demographics in their planning are 60% more likely to achieve their strategic objectives.” Really, I’m only surprised it isn’t higher.

Map and Assess Your Geographic Footprint

Another type of scanning involves analyzing the key demographics of your customers and creating a geographic footprint of where your key customers reside. This is intended to provide invaluable spatial understandings.

One solid way to do this is to draw a map of the service, sites, and community facilities you offer in your community. (Feel free to use technology to create reliable sketches.) Then overlay this footprint with the demographic maps and data you gathered, assessing such things as:

- Are you conveniently located close to the populations you want to serve?

- How precisely aligned is your footprint with shifting community needs?

- Are certain neighborhoods, areas, or demographic groups glaringly underserved compared to others?

- What gaps or opportunities exist to better reach and serve priority communities?

In so doing, you might find that a neighborhood of mostly young families lacks any of your youth programs… that grandparents lunch downtown while your senior center is in the suburbs and only available by car… that lower income areas have less access to your locations… or that key rural populations have to drive long distances to access your services.

Are you underinvesting in your physical infrastructure and thereby losing opportunities for growth? Are you geographically misallocated with assets in the wrong locations? Are your service models and sites misaligned with shifting demographics? These are the issues you can discover and therefore correct.

This kind of analysis should give you new ideas about how best to rebalance your footprint in relation to emerging needs and demands. Indeed, for organizations seeking a strategic expansion, applying footprint optimization in the Open Footprint® Data Model – a program developed by a 900-member global consortium – has an average 30% average increase in service utilization.

Gather Insights From Diverse Stakeholders

Here’s another question a scan can answer: What do we see when we look at our organization through our stakeholders’ eyes? And by stakeholders, I mean clients and beneficiaries, program partners, funders and donors, community leaders, referral sources, the general public, staff, board members, volunteers…

The list isn’t short.

They’re going to have their own distinct answers about what’s important to them, what their hopes and dreams are, and how best you can serve them. These varied views are invaluable and should help round out your understanding of your external environment.

So what are the best ways to engage that environment? You might automatically think of surveys, and that is a legitimate option. They’re great for widely distributing questions to clients, employees, partners, and the larger public – all without raising concerns about whether participants will suffer consequences for their honesty.

Anonymity can be a powerful motivator when you want the truth about what you’re doing well, where you can improve, and ideas for the future. Better yet, you can advance your reach and response time by using online platforms to send out surveys if you so choose.

But there are other ways to gather this data, including setting up focus groups. While this can take more organization on your part, assembling stakeholders to discuss existing perceptions and needs in person might be the route you need to take. Instead of getting single-word or sentence answers, you can probe further into areas of interest this way.

Hosting a community forum is another option, where open meetings allow people to share opinions and suggestions around and about strategic issues. Or how about scheduling one-on-one interviews with key informants like community leaders, partners, and influencers? This way, you can gain qualitative insights on their priorities, concerns, and community visions.

Advisory councils, meanwhile, are designed to provide guidance from diverse stakeholders. They exist for you to consult them on emerging issues, needs, and strategic questions.

Regardless of which resource you choose, make sure to be on the lookout for:

- Whether your target market is satisfied with your programs and services

- What emerging community needs or expectations they see

- What external concerns and threats they think you should address

- What opportunities or partnerships you should explore

- What people care about, how they see the neighborhood developing, and whether your current approach fits.

Regular stakeholder engagement provides an invaluable outside perspective. And it builds crucial relationships, boosting an organization’s reputation, trust, and community goodwill.

Don’t underestimate the power of proactively seeking outside viewpoints. They’re more valuable than I can possibly state here in mere black and white.

Involve Employees and Volunteers

You also have a great resource in your on-site team members as well. “Scanning” them can help you better address organizational strengths and weaknesses… on-the-ground challenges facing clients… operational pain points and opportunities… ideas to enhance programs and partnerships… capabilities you could better leverage… and needed changes for the future.

As with your customer and potential customer base, there are plenty of ways you can reach them, including surveys. These inquiries can ask bold questions like, “If you ran this organization, what changes would you make?” Get employee input – at all levels – about what’s working well, what their biggest organizational challenges are, and what they hope things will look like five years from now.

Or you can convene an in-house focus group of employees and volunteers to discuss perspectives on external trends, issues, and ideas. Use department meetings, form advisory committees, or conduct one-on-one interviews to explore individual insights on strategic issues and community needs. And establishing ongoing online channels for employees to submit insights and ideas can be just as effective.

When you gather workforce insights, regardless of the format, make sure to look for patterns and themes across groups and levels. Triangulate with other data sources to focus on the most critical issues. Distill suggestions into strategy-relevant insights vs. operational details. And identify potential blind spots or groupthink that internal scanning alone might miss.

Take it from strategic planning and performance management software company Envisio. It reports that embracing your employees’ input during the planning stages results in an average 20% higher worker engagement and satisfaction. Even better, it will yield more effective and realistic strategies grounded in the local knowledge of your frontline workers.

Don’t ever underestimate the value of their perspective.

Synthesize Learnings into a SWOT Analysis

A SWOT analysis distills your diligent external and internal scanning into a strategic framework. We introduced this concept earlier in the book, but let’s break it down further here. The acronym is meant to encourage an exploration of:

- Strengths – internal advantages to build on

- Weaknesses – internal vulnerabilities to address

- Opportunities – external factors you can capitalize on

- Threats – external forces you need to prepare for and mitigate.

Keep in mind that this high-level, outside-in scan is meant to guide your planning. To facilitate this, you’ll want to summarize your key findings and insights by:

- Synthesizing themes and outliers from across data sources

- Clustering related findings into coherent opportunities, threats, and strategic insights

- Framing insights using terminology the team agrees on.

- Facilitating sessions to refine the draft SWOT with stakeholders and your team.

This will help you accurately capture key learnings from scanning. To really boost your results though, again try using techniques like multi-voting to prioritize top items in each SWOT category.

Small groups, meanwhile, can review draft findings; and surveys ask important questions like, “What resonates most?” Discussions on implications and priority strategic issues can also amplify your efforts.

A well-timed, confident SWOT will put you in a position to make the right calls at the right times, highlighting where your strategy might need rebalancing in response to changes in the marketplace. In fact, a classic SWOT framework can greatly improve the quality of decisions about strategy – by up to 35%, according to Forbes Advisor Jeff White.

What Now?

This outside-in perspective reveals key insights on trends, stakeholders, and strategic issues. But it’s only half the picture. You also need to gain an inside-out view by taking stock of internal organizational capabilities. Resources, strengths, weaknesses…

What do you have to work with? That’s what the next post covers in detail.

Receive Blog Updates

|

|

Thank you for Signing Up |